As digital transformation accelerates, two of the most disruptive trends—cryptocurrencies and the metaverse—are converging to reshape the financial landscape. This powerful fusion is creating entirely new economies, business models, and investment opportunities that are already impacting how people interact with money in the digital age.

In this article, we’ll explore how crypto is becoming the backbone of financial transactions in virtual worlds, what this means for investors and users, and why understanding this trend is essential for anyone interested in the future of finance.

What Is the Metaverse?

The metaverse refers to a shared virtual space where users can socialize, work, shop, and play as digital avatars. Think of it as an immersive internet, powered by technologies like virtual reality (VR), augmented reality (AR), and blockchain. Major tech companies like Meta, Microsoft, and Nvidia are investing heavily in this next evolution of digital interaction.

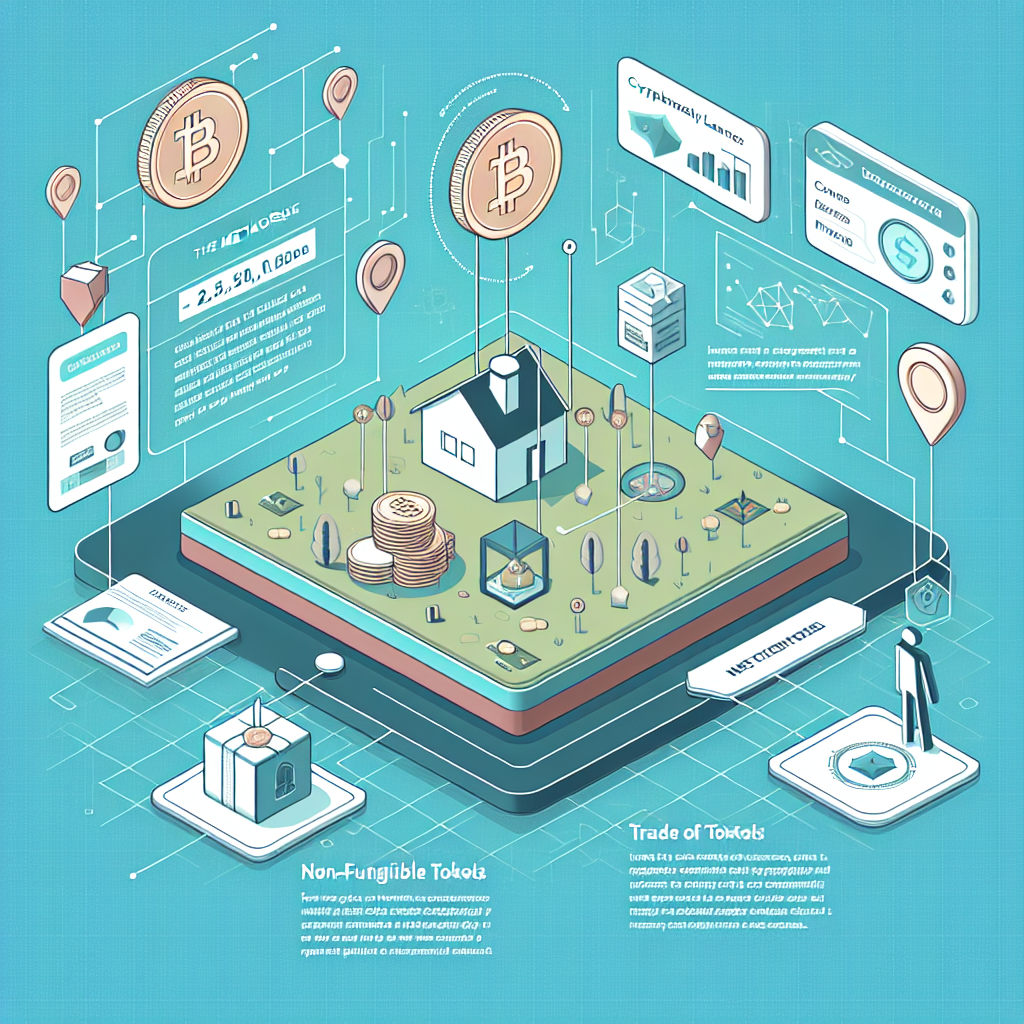

The Role of Cryptocurrencies in the Metaverse

Cryptocurrencies are decentralized digital currencies that enable peer-to-peer transactions without the need for intermediaries. Within the metaverse, they play a crucial role by serving as the native currencies for buying digital assets, paying for services, and participating in decentralized finance (DeFi) ecosystems.

Real-World Example:

In platforms like Decentraland and The Sandbox, users buy virtual land, clothes for avatars, and even attend virtual concerts—using cryptocurrencies like MANA or SAND. These assets can be traded on blockchain networks, creating real economic value in virtual worlds.

Key Advantages of Crypto in the Metaverse

- Decentralization – Users have full control over their assets without relying on banks or central authorities.

- Borderless Transactions – Anyone with internet access can participate in the metaverse economy.

- New Revenue Streams – From renting virtual real estate to selling NFT-based art or fashion, new ways to earn income are emerging daily.

- Smart Contracts – These automate transactions and agreements without human intervention, increasing transparency and efficiency.

Potential Risks to Watch

While the opportunities are exciting, it’s also important to be aware of the risks:

- High Volatility – Crypto values can fluctuate wildly, impacting investments.

- Lack of Regulation – The legal framework around crypto and digital assets is still evolving.

- Security Concerns – Hacks, scams, and rug pulls remain common in the space.

- User Inexperience – Many people enter this space without fully understanding the risks.

The Financial Future of the Metaverse

Big brands and institutions are already entering the metaverse. Nike is selling digital sneakers, JPMorgan Chase has opened a virtual branch, and fashion giants are creating NFT wearables. As adoption grows, we’re likely to see:

- Full-scale digital banks and decentralized insurance services.

- Tokenized ownership of physical and digital assets.

- Integration between real-world and metaverse economies.

Final Thoughts

The synergy between cryptocurrencies and the metaverse marks a revolutionary shift in how value is created, transferred, and stored. Understanding this new financial infrastructure is not just for tech enthusiasts—it’s for anyone looking to stay ahead in a rapidly changing economic environment.

Pro Tip: Before diving into crypto or metaverse investments, do thorough research. Use secure wallets, avoid suspicious links, and consider long-term strategies rather than chasing quick profits.